In a world where consumerism is often glorified and instant gratification is just a swipe away, learning how to save money is one of the most valuable skills a teenager can develop. Cultivating good financial habits early on not only prepares teens for independence but also helps them build a solid foundation for future financial success. Here are some compelling reasons why saving money is an essential skill for teenagers.

Saving money is not just about putting away a portion of your allowance or earnings—it’s about learning self-discipline. Teenagers often face temptations to spend on the latest gadgets, trendy clothing, or fast food. By practicing saving, teens learn to make thoughtful decisions and resist the urge to spend impulsively. This habit of delayed gratification not only fosters financial discipline but also strengthens other aspects of personal responsibility, such as setting and meeting goals.

For instance, if a teen decides to save for a special purchase, like a new phone or a concert ticket, they will learn to budget and prioritize their spending. This experience helps build a sense of control over their financial choices and encourages them to think long-term rather than focusing on immediate desires.

As teenagers start to take on part-time jobs or earn money through other means, they gain an increasing amount of financial independence. However, with this newfound autonomy comes the responsibility of managing money effectively. Teens who learn to save early on are better equipped to handle their finances without relying on their parents or guardians for constant support.

Saving money can help teens pay for their own expenses, such as clothes, entertainment, or even a car. It also prepares them for more significant financial responsibilities in adulthood, like paying for college, rent, or healthcare. Being able to manage and save money as a teenager sets the stage for a future where financial independence is a realistic and attainable goal.

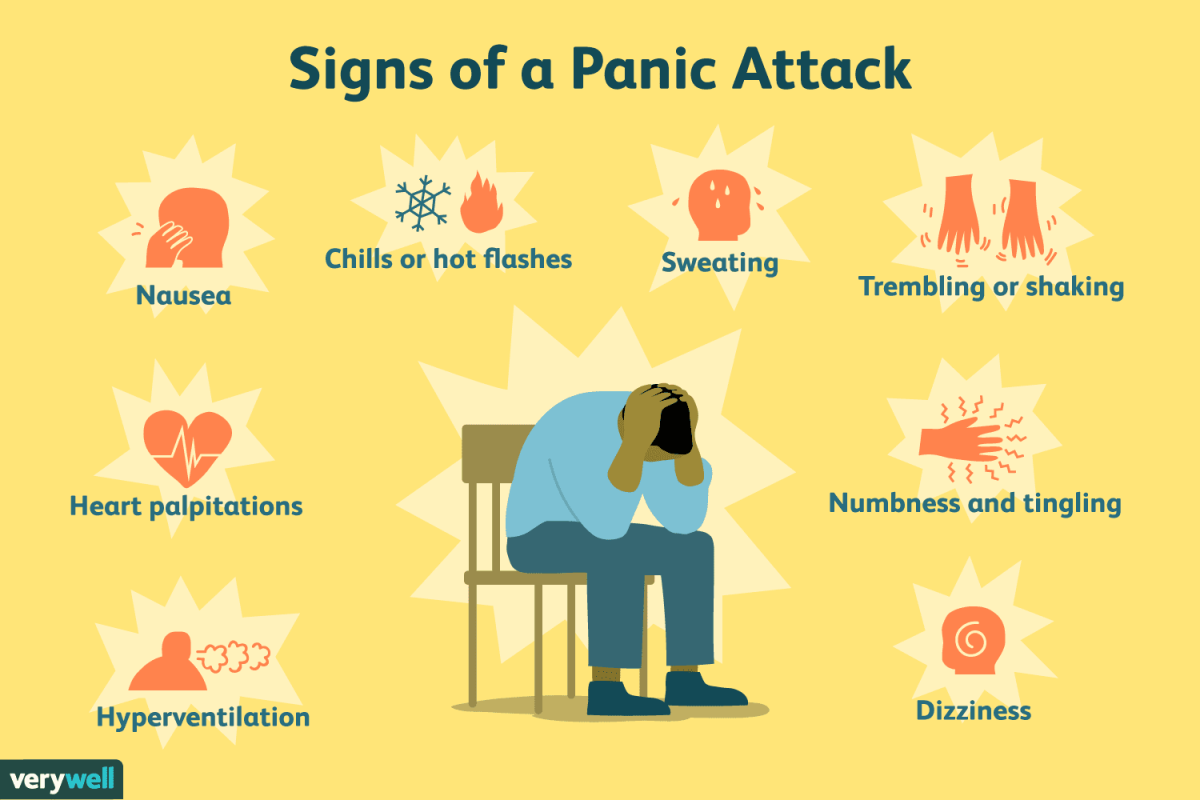

Life is full of surprises, and not all of them are pleasant. Whether it’s an unexpected medical bill, a broken phone, or an emergency, having savings can provide a sense of security. By learning how to set aside money for unexpected expenses, teenagers can avoid stress when faced with financial challenges.

Teens who develop an emergency fund early are also less likely to rely on credit cards or loans to cover unforeseen costs. This can prevent the accumulation of debt, which is a trap many young adults fall into when they don’t have the skills or mindset to manage their finances wisely.

Learning to save is also the first step toward understanding investing. Although teens may not be actively investing in stocks or real estate yet, the habit of saving can help them build the confidence and financial knowledge they need to make smart investment decisions in the future. By regularly setting aside money, teens can learn about the power of compound interest and how small savings over time can lead to larger financial gains. Starting to save as a teenager can help them develop a mindset of wealth-building that will benefit them in adulthood.

When teenagers begin to save money, they are introduced to basic concepts of budgeting, interest rates, and money management. This encourages financial literacy, which is an essential skill for navigating adult life. Teens who understand how to track their spending, create budgets, and manage savings are better prepared to make informed financial decisions as they grow older.

In today’s world, financial literacy is more important than ever, and the earlier teens learn these concepts, the more confident and capable they will be when managing their finances in adulthood.

Saving money as a teenager is about more than just building a nest egg—it’s about cultivating important life skills like responsibility, independence, and financial literacy. By learning how to save early, teens can set themselves up for a future of financial stability and success. Whether it’s for a rainy day, a big purchase, or long-term goals, the ability to save money is a skill that pays dividends for years to come.